Harvey.ai vs. Tucan.ai: Comparison of AI tools for legal practice - USA vs. Germany

AI-supported tools are becoming increasingly important in the dynamic world of legal services. They offer law firms and legal departments the opportunity to increase their efficiency and automate repetitive tasks. First let's take a look at Harvey.ai vs. Tucan.ai: A comparison of AI tools for legal practice - USA versus Made in Germany. In the following, the functionality, strengths and weaknesses of these tools are examined in detail to help you make an informed decision.

Table of contents

Functionality comparison

| Function | Harvey.ai | Tucan.ai |

|---|---|---|

| AI-supported document analysis | Yes | Yes |

| GDPR compliance | Depends on data processing | Yes |

| Automatic transcription | Limited to document processing | Yes |

| Customizable templates | No | Yes |

| Multi-document insights | Yes | Yes |

| Integration with MS Word | Yes | No |

| Natural language interface | Yes | Yes |

In addition, Harvey.ai offers integration with MS Word, while Tucan.ai scores with its adaptability for templates.

Strengths and weaknesses

Harvey.ai

Strengths:

- Specialization in legal tasks: Harvey.ai offers a domain-specific AI that has been specially developed for law firms. This enables the precise processing of complex legal issues.

- Integration with Microsoft Word: Seamless integration makes it much easier to create and revise documents.

- Extensive database access: Access to global tax case law and case law from various countries supports in-depth research.

Weaknesses:

- However, the complexity of the setup could be challenging for smaller law firms.

- Data protection concerns: As a US company, there may be concerns regarding the GDPR.

Tucan.ai

Strengths:

- Data protection compliance: Developed in Germany, Tucan.ai offers strict compliance with GDPR guidelines - a decisive advantage for European law firms.

- Automated contract analysis: The fast and precise analysis of contracts significantly increases efficiency.

- Versatile transcription capability: Automatic transcription and summaries of meetings facilitate follow-up work.

Weaknesses:

- On the other hand, integration with other systems could be complex.

- Focus on the German market: This could limit the attractiveness for international law firms.

Benefits for legal practice

Tucan.ai offers specific advantages for legal practiceespecially through its ability to efficiently transcribe meetings and make this information accessible for later analysis. This makes it much easier to track meetings and automate workflows.

Decision guidance for law firms: Harvey.ai vs. Tucan.ai

In summary, both platforms offer valuable features for law firms and legal departments. While Harvey.ai impresses with its integration into existing systems, Tucan.ai offers a clear advantage for German-speaking users thanks to its GDPR compliance and versatile transcription capabilities.

Ultimately, the choice between these tools depends on the specific requirements of your law firm. For lawyers, law firm partners, CIOs, legal departments and innovation managers, we offer Tucan.ai is a tailor-made solution that not only guarantees data protection, but also revolutionizes work processes.

Experience the difference a specialized AI solution can make in your daily work and choose the tool that best suits your needs!

Are you ready to optimize the way you work?

AI in Legal Practice: Vetting and Implementing AI Solutions (2024 Guide)

In today's rapidly evolving legal landscape, artificial intelligence (AI) is revolutionizing how law firms and legal departments operate. This guide explores the key considerations for legal professionals when vetting AI products and implementing AI systems within their organizations.

Table of Contents

Understanding AI Technologies in Legal Practice

AI technologies, particularly Large Language Models (LLMs) like GPT-4, are transforming the legal industry. However, it's crucial to understand both their capabilities and limitations.

Capabilities of LLMs

LLMs are primarily trained to generate sentences based on probability, rather than truly understanding text. In their standard versions, these models can accurately answer about 57% of complex legal questions, such as those related to tax law.

Enhancing Accuracy with RAG Systems

To improve accuracy, many legal AI solutions employ Retrieval-Augmented Generation (RAG) systems. These advanced systems can significantly boost performance:

- RAG systems can increase accuracy to over 87%

- Advanced chunking technologies can push results even further, reaching up to 96% accuracy

Moreover, RAG systems allow for result verification by providing exact sources for generated information, adding an extra layer of reliability.

Challenges in AI Implementation

While AI offers numerous benefits, legal professionals must be aware of potential pitfalls when implementing these systems.

AI Hallucinations

AI hallucinations can occur due to several factors:

- Unstructured data inputs (e.g., PDFs, images, complex contract constellations)

- Unclear user prompts that require extensive background knowledge

Data Processing Hurdles

Effective AI implementation requires careful attention to data processing:

- Content chunking across multiple documents is essential

- Structured document labeling should be implemented where possible

Best Practices for AI Implementation

To successfully integrate AI into your legal practice, consider the following steps:

- Start with a well-defined use case, such as analyzing ICT contracts for DORA regulation compliance

- Define expected results and benchmarks to measure success

- Decide between external providers and internal systems, or a combination of both

- Test and expand gradually, for example, from DORA to GDPR contract analysis

Vetting AI Service Providers

When evaluating AI service providers, it's important to consider several factors:

- Company history: How long have they been in the market?

- Technology claims: Are they developing proprietary models or using existing ones?

- Deployment options: Can their services be installed on-premise?

Building In-House AI Systems

For organizations considering in-house AI development, there are several key considerations:

- Evaluate hosting options (internal vs. cloud)

- Choose appropriate AI models (e.g., LLama 3, Mistral, OpenAI)

- Determine specific use cases (legal research, contract writing, due diligence)

Reshaping the Legal Industry

As AI continues to reshape the legal industry, it's crucial for lawyers, partners, legal departments, and CIOs to stay informed about the latest developments and best practices. By carefully vetting AI products and implementing robust systems, legal professionals can harness the power of AI to enhance efficiency, accuracy, and client service.

In conclusion, the integration of AI in legal practice offers immense potential, but it requires thoughtful consideration and strategic implementation. As we move forward, those who successfully navigate this technological shift will undoubtedly gain a competitive edge in the evolving legal landscape.

Ready to elevate your practice?

AI Implementation in Law Firms: 5 Essential Best Practices

In today's rapidly evolving legal landscape, artificial intelligence (AI) is becoming an indispensable tool for law firms seeking to enhance efficiency and service quality. However, successful AI implementation requires careful planning and execution. Let's explore five crucial best practices for legal professionals looking to integrate AI into their practice.

Table of Contents

1. Start with a Well-Defined Use Case

The foundation of successful AI implementation lies in selecting a specific, manageable area of focus. For instance, analyzing ICT contracts for DORA regulation compliance provides a clear, bounded objective. When choosing your use case, consider the following:

- Align it with your firm's strategic goals

- Ensure it addresses a significant pain point

- Consider the potential impact on workflows and client service

By starting with a focused approach, you can minimize risks and maximize learning opportunities.

2. Define Clear Expectations and Benchmarks

Setting measurable goals is crucial for evaluating the success of your AI implementation. To do this effectively, follow these steps:

- Establish specific Key Performance Indicators (KPIs)

- Create a baseline of current performance metrics

- Set realistic goals based on industry standards

Moreover, consider both quantitative metrics (e.g., time saved, accuracy rates) and qualitative factors (e.g., user satisfaction, client feedback) when defining your benchmarks.

3. Choose Between External Providers and Internal Systems

Deciding whether to build in-house or outsource your AI solution is a critical decision. To make an informed choice, weigh these factors:

- In-house development offers greater control but requires significant resources

- External providers can offer faster implementation but may provide less flexibility

- A hybrid approach can combine external expertise with internal knowledge

Therefore, assess your firm's technical capabilities, budget constraints, and long-term AI strategy when making this decision.

4. Implement a Gradual Testing and Expansion Strategy

A phased approach to AI implementation allows for careful testing and refinement. To execute this strategy effectively:

- Begin with a limited pilot project

- Conduct thorough testing in a controlled environment

- Gather and analyze user feedback

- Develop a phased rollout plan for expansion

This approach allows you to make necessary adjustments and optimizations at each stage, ensuring a smoother overall implementation.

5. Invest in Training and Change Management

While not explicitly mentioned in the initial points, successful AI implementation heavily depends on user adoption and proficiency. To ensure this:

- Provide comprehensive training for all users of the AI system

- Develop clear guidelines and best practices for AI usage

- Address potential resistance to change through education and demonstrating tangible benefits

By following these best practices, legal firms can create a solid foundation for successful AI implementation, ensuring that the technology enhances their practice while minimizing potential risks and disruptions.

In conclusion, remember that AI implementation is an ongoing process. Continuously monitor your system's performance, solicit feedback, and stay informed about emerging AI technologies to maintain a competitive edge in the legal industry.

Ready to elevate your practice?

AI Implementation in Legal Practice: Overcoming Challenges in 2024

In 2024, the legal profession stands at the cusp of a technological revolution driven by Artificial Intelligence (AI). As law firms and legal departments increasingly adopt AI solutions, it's crucial to understand and address the potential pitfalls that can arise during implementation. This article explores the key challenges in AI implementation for legal practices and provides actionable strategies to overcome them.

Table of Contents

AI Hallucinations: A Critical Concern

One of the most pressing challenges in AI implementation is the occurrence of AI hallucinations. These inaccuracies can significantly impact the reliability of AI-generated legal content and analysis.

Causes of AI Hallucinations:

- Unstructured data inputs, such as PDFs, images, and complex contract constellations

- Unclear user prompts that require extensive background knowledge

Mitigation Strategies:

- Implement structured document labeling to improve data clarity

- Utilize content chunking techniques to group related information across multiple documents

- Employ Retrieval-Augmented Generation (RAG) systems to enhance accuracy and provide verifiable sources

Data Processing Challenges

Effective AI implementation in legal practice hinges on robust data processing capabilities.

Key Requirements:

- Content chunking across multiple documents

- Structured document labeling where possible

Solutions:

- Develop or adopt advanced chunking technologies that break up texts by topic

- Implement vector databases for efficient information retrieval and processing

Prompting Challenges

The quality of AI-generated outputs heavily depends on the clarity and specificity of user prompts.

Common Issues:

- Unclear or ambiguous prompts lead to inaccurate results

- Lack of context in user queries

Best Practices:

- Utilize a prompting cheat sheet to structure queries effectively

- Provide clear context and role instructions for the AI system

- Specify expected results and desired output format

- Consider implementing reranking systems to reformulate and analyze prompts for more relevant results

Ensuring Data Quality and Security

As legal practices handle sensitive information, maintaining data integrity and security is paramount when implementing AI systems.

Key Considerations:

- Implementing robust data governance policies

- Regular auditing and cleaning of data to improve AI performance

- Employing strong security measures to protect confidential legal information

By addressing these challenges proactively, legal professionals can significantly enhance the accuracy, reliability, and security of their AI implementations. This approach leads to more effective and trustworthy AI-assisted legal work, ultimately improving efficiency and client service.

Ethical and Professional Considerations

As legal practices handle sensitive information, maintaining data integrity and security is paramount when implementing AI systems.

Key Considerations:

- Transparency and explainability of AI-driven decision-making processes

- Maintaining human oversight and accountability

- Mitigating algorithmic bias to ensure fairness and equity

Strategies for Addressing Ethical Challenges:

- Implement mechanisms for bias detection and algorithmic fairness

- Ensure transparency in AI-driven processes and decisions

- Maintain human oversight and intervention capabilities

- Engage in ongoing ethical reflection and adaptation

Overcoming Resistance to Change

Resistance to change and fear of job displacement pose significant challenges to widespread AI adoption in legal practice.

Strategies for Addressing Resistance:

- Provide comprehensive training and upskilling programs for legal professionals

- Emphasize AI as a tool to augment human expertise rather than replace it

- Demonstrate the benefits of AI in improving efficiency and reducing costs

- Foster a culture of technological literacy and innovation within legal organizations

As the legal industry continues to embrace AI technologies, staying informed about these challenges and their solutions is crucial for successful implementation. By leveraging these strategies, law firms and legal departments can navigate the complexities of AI adoption and harness its full potential to transform their practice.

Ready to elevate your practice?

Automatic contract analysis in three simple steps.

Contract analyses can be time-consuming and complex. With our software, however, this process can be highly simplified. Let us show you how to analyze contracts quickly and efficiently inthree simple steps.

Step 1: Create a project and upload your contracts

Log in and create your project. Easily upload your contracts and documents to the software. Optionally, already linked document collections and databases can be added with a simple click.

Step 2: Have your contracts analyzed automatically

After uploading, you can start the automatic evaluation immediately. Our software analyzes your contracts at lightning speed and provides you with precise answers and detailed source information in just a few moments. If the answers do not meet your expectations, you can simply update them or have them analyzed again.

Especially useful: You can also use automatic evaluations according to predefined templates, for example for DORA third-party provider contracts.

Step 3: Export your results

Once you are satisfied with the analysis, you can simply export the results. Choose from various formats and download the results or send them directly by e-mail. One click is all it takes and your comprehensive contract analysis is ready for further processing or sharing.

With Tucan.ai, contract analysis becomes a quick and uncomplicated task. You save time and receive well-founded results. Simply try it out and see the efficiency and simplicity for yourself.

Start your AI-powered contract analysis now!

DORA | Management of ICT third party risks: Contract review and due diligence with AI

The management of ICT third-party risks is a central component of the Digital Operational Resilience Act (DORA). Financial companies and their ICT service providers must ensure that their third-party providers also meet the requirements for digital resilience and security. In this blog post, we take a detailed look at contract review and due diligence and show how artificial intelligence (AI) can make these processes considerably easier and automate them as far as possible.

DORA Cheat Sheet: Contract review for ICT third party risks

Table of contents

Why is the management of ICT third-party risks important?

Third-party providers play a decisive role in the value chain of financial companies. They offer specialized services and technologies that are essential for operations. However, they also entail additional risks that need to be managed. An outage or security breach at a third-party provider can have a significant impact on the entire company.

1. Contract review

Goal of the contract review:

- Ensure that all contracts with third-party providers contain clear provisions on ICT security and resilience.

- Avoidance of risks due to unclear or inadequate contractual provisions.

Important contractual clauses:

- Security requirements: Clear specifications of the security measures that the third-party provider must comply with.

- Reporting of incidents: Obligation of the third-party provider to report ICT-related incidents immediately.

- Review capabilities: The financial institution should have the ability to occasionally review the security practices of the third-party provider.

- Continuity planning: arrangements to ensure business continuity in the event of ICT disruptions or failures.

Automated contract review with artificial intelligence (AI):

AI-powered contract review solutions can help you ensure that your contracts comply with DORA requirements. With Tucan.ai you can, for example:

- Check contracts quickly and efficiently for security-relevant clauses.

- Create detailed and automatic contract comparisons and subsumptions.

- Save time and resources by reducing manual inspection processes.

DORA Cheat Sheet: Contract review for ICT third party risks

2. Due Diligence

Objective of the due diligence

- Thorough review of the third party provider's ICT security practices and capabilities.

- Ensure that the third-party provider is able to fulfill the contractually agreed security requirements.

Important steps in due diligence:

- Security assessments: Conducting security assessments and audits at the third-party provider.

- Risk assessment: Identification and assessment of potential risks that could arise from working with the third-party provider.

- Continuous monitoring: Establish a system for continuous monitoring of the third-party provider's security practices.

Automated due diligence with artificial intelligence (AI):

With AI solutions such as Tucan.ai, you can significantly simplify and automate the due diligence process. You can, for example:

- Perform automated identification and analysis of critical contract terms.

- Reduce time and costs by minimizing manual checks in the due diligence process.

- Quickly identify potential legal and financial risks in contractual documents.

DORA Cheat Sheet: Contract review for ICT third party risks

The ICT third-party risk management factor

Managing ICT third party risks is critical to complying with DORA requirements and ensuring your organization's digital resilience. Through thorough contract review and due diligence, you can ensure that your third-party providers meet high security standards.

Artificial intelligence can be used to make these processes efficient and effective. Use AI-powered solutions like Tucan.ai to optimize your contracts and due diligence practices and ensure your company is well prepared to meet the challenges of digital resilience.

About Tucan.ai

Tucan.ai is a leading provider in the field of legal tech and offers innovative solutions for contract analysis and review.. With Tucan.ai's AI-powered technology, you can save time and resources and ensure that your contracts comply with the latest legal requirements.

Stay prepared and secure the digital future!

Digital Operational Resilience Act: DORA implementation made easy

The implementation of the Digital Operational Resilience Act (DORA) poses new challenges for financial companies and their ICT service providers. This regulation aims to strengthen digital resilience and ensure that companies are able to respond effectively to ICT-related disruptions and threats. In this blog post, we provide you with an overview of the most important steps and measures for the successful implementation of DORA.

DORA Cheat Sheet: Contract review for ICT third party risks

Table of contents

1. Implement ICT risk management

A robust ICT risk management system is at the heart of DORA. Here are the essential steps:

- Risk identification: Identify all potential ICT risks that could affect your company.

- Risk assessment:Evaluate the identified risks in terms of their probability and potential impact.

- Risk mitigation: Develop and implement measures to minimise the identified risks.

- Monitoring and review: Continuously monitor the risks and regularly review the effectiveness of your risk minimisation measures.

2. Management of ICT third-party risks

Collaboration with third-party providers harbors additional risks. The following points should be noted:

- Contract review: Ensure that all contracts with third-party providers contain clear provisions on ICT security and resilience.

- Due diligence: Conduct a thorough review of the ICT security practices of your third-party providers.

- Continuous monitoring: Regularly monitor the performance and security of your third-party providers.

3. Reporting of ICT-related incidents

A quick and effective response to ICT incidents is crucial:

- Incident recording: Develop a system to record all ICT-related incidents.

- Incident analysis: Analyze the incidents to identify the causes and develop measures to prevent future incidents.

- Reporting: Report serious incidents immediately to the relevant authorities in accordance with DORA requirements.

4. Testing digital operational resilience

Regular testing is essential to ensure the resilience of your business:

- Situation analyses: Consider conducting situational analyses to assess the efficiency of your ICT incident response processes.

- Security checks: It may be helpful to occasionally call in external experts to check your systems for any vulnerabilities.

- Vulnerability resolution: Fix identified vulnerabilities immediately and update your security measures.

5. Exchange of information between financial companies

Sharing information about threats and incidents can strengthen collective resilience:

- Networks and platforms: Use networks and platforms to share information about ICT threats and incidents.

- Best practices: Share best practices and lessons learned with other companies to increase resilience together.

6. Documentation and reporting

Thorough documentation and regular reporting are essential:

- Documentation: Document all the measures you take to implement DORA.

- Reporting: Prepare regular reports for management and the relevant authorities on the progress and results of your measures.

Support through artificial intelligence (AI)

Implementing DORA can be complex, but with the right tools and partners you can meet the requirements effectively. Tucan.ai offers innovative innovative contract analysis and review solutions to help you ensure that your contracts comply with DORA requirements. Use Tucan.ai's AI-supported technology to save time and resources and identify and eliminate potential risks at an early stage.

DORA Cheat Sheet: Contract review for ICT third party risks

Careful planning and implementation

The successful implementation of DORA requires careful planning and execution. By following the steps above, you can ensure that your company is well prepared to meet the new requirements and strengthen digital resilience. Use Tucan.ai's support to review your contracts and processes and ensure that you comply with the new regulations.

About Tucan.ai

Tucan.ai is a leading provider in the field of legal tech and offers innovative solutions for contract analysis and review.. With Tucan.ai's AI-powered technology, you can save time and resources and ensure that your contracts comply with the latest legal requirements.

Stay prepared and secure the digital future!

DORA: The Digital Operational Resilience Act - What you need to know

The digital transformation brings many advantages, but also challenges, especially for financial companies and their ICT service providers. To increase resilience to digital risks, the EU has introduced the Digital Operational Resilience Act (DORA). DORA comes into force on January 17, 2025, and ensures that financial companies and their service providers are prepared for digital attacks and disruptions. In this blog post, we explain what DORA is all about and what you need to bear in mind.

Table of contents

What is DORA?

DORA is an EU regulation that aims to strengthen the digital operational resilience of financial companies and their ICT service providers. The aim is to improve the ability of these organizations to respond to and recover from all types of ICT-related disruptions and threats.

Who is affected by DORA?

DORA affects a large number of financial companies, including:

- Credit institutions

- Payment institutions

- Investment firms

- Insurance companies

- Fund management companies

- Stock exchanges and trading platforms

Important: ICT service providers that support these companies are also covered by DORA.

Important requirements of DORA

1. ICT risk management

- Financial companies must introduce a robust ICT risk management system.

- Identification, assessment and mitigation of ICT risks are essential.

- Regular review and update of ICT risk management strategies.

2. management of ICT third-party risks

- Financial companies must ensure that their third-party providers and service providers also comply with the DORA requirements.

- Contracts with third-party providers should include provisions on ICT security and resilience.

3. reporting of ICT-related incidents

- Financial companies must report serious ICT incidents to the competent authorities without delay.

- A systematic approach to recording, analyzing and reporting incidents is required.

4. Testing digital operational resilience

- Regular tests of resistance to ICT disruptions and attacks are mandatory.

- Simulation exercises and penetration tests should be carried out to identify and eliminate vulnerabilities.

5. Exchange of information between financial companies

- Promoting the exchange of information on threats and incidents between financial companies.

- Collaboration to strengthen the collective resilience of the industry.

Implementation of DORA

Implementing DORA can be complex, but with the right tools and partners you can meet the requirements effectively. This is where Tucan.ai comes into play. With Tucan.ai, you can check contracts for DORA-specific requirements and ensure that your agreements with third-party providers comply with legal requirements. Tucan.ai offers an intelligent solution for contract analysis and helps you to identify and eliminate potential risks at an early stage.

Early preparation

DORA represents a significant change for financial companies and their ICT service providers. It is crucial to start preparing early in order to meet the requirements in good time and strengthen digital resilience. Use tools like Tucan.ai to review your contracts and processes and ensure you are compliant with the new regulations.

DORA Cheat Sheet: Contract review for ICT third party risks

About Tucan.ai

Tucan.ai is a leading provider in the field of legal tech and offers innovative solutions for contract analysis and review.. With Tucan.ai's AI-powered technology, you can save time and resources and ensure that your contracts comply with the latest legal requirements.

Stay prepared and secure the digital future!

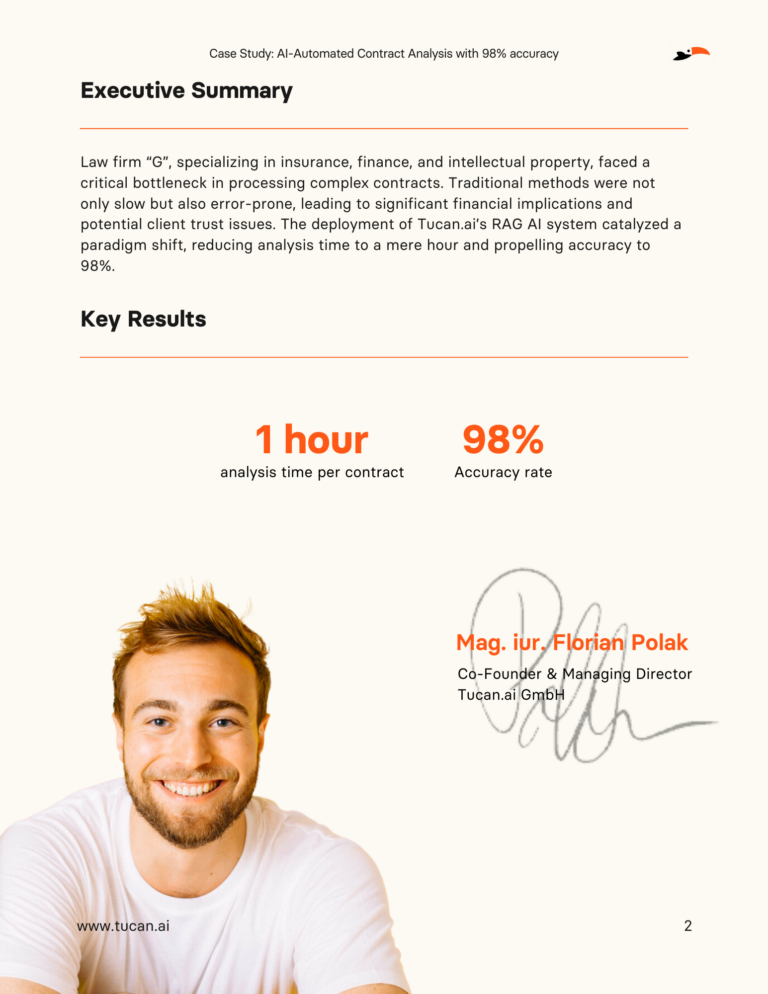

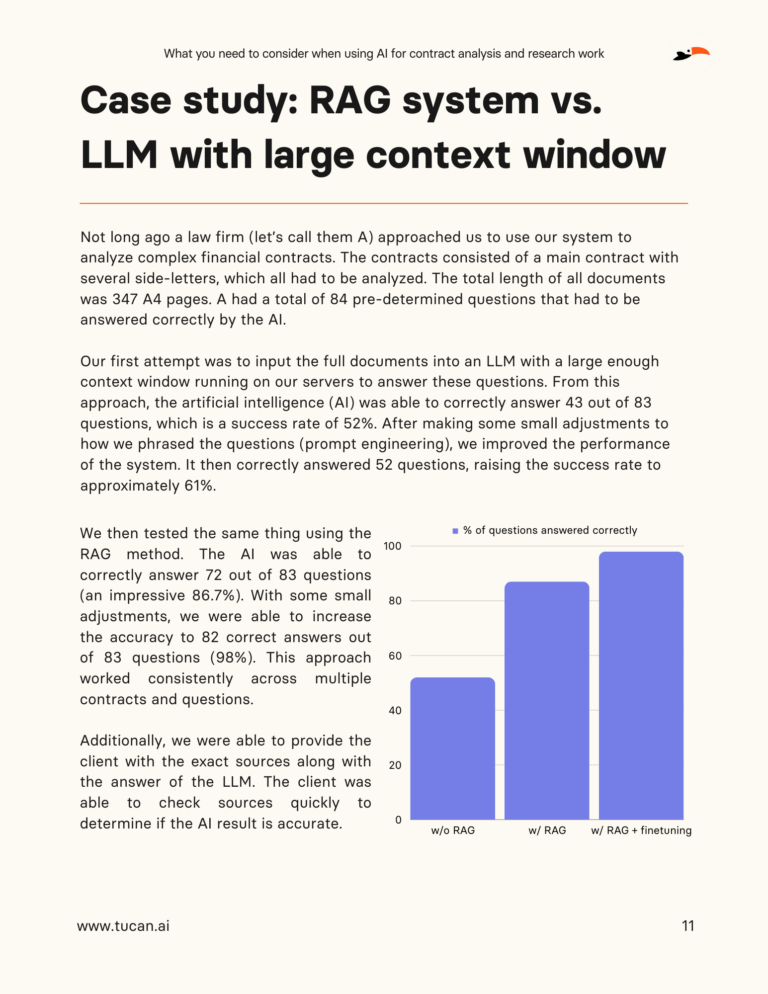

Case Study: AI-Automated Contract Analysis with 98% accuracy

Download the case study for free!

Discover how one law firm transformed its contract analysis processes by implementing Tucan.ai's system:

Key Results

This case study shows how the use of AI technology not only significantly increases efficiency in contract analysis, but also improves legal accuracy and shortens processing times:

- Dramatic acceleration: Reduce analysis time for complex contracts to just one hour.

- High accuracy: Thanks to the innovative chunking technique, the AI achieved an analysis accuracy of 98%, which strengthens confidence in the legal processes.

- Strategic improvements: Scalable results through the implementation of the RAG AI system, with consistency across multiple contracts and results with accurate source citations.

These innovations have not only simplified contract analysis, but have also strengthened the firm's strategic performance.

Download the case study for free!

We advise you on your use case!

What you need to consider when using AI for contract analysis and research work

Download the whitepaper for free!

The advent of Artificial Intelligence (AI) has ushered in a new era of efficiency and effectiveness in various industries, with the legal field being no exception. As the complexity of legal cases increases alongside the exponential growth of data, AI appears as a beacon of hope for streamlining operations, cutting costs, and enhancing the accuracy and quality of legal work. However, the integration of AI in legal contexts is not devoid of challenges. In our whitepaper, "What you need to consider when using AI for contract analysis and research work," we dive into these very issues, providing legal professionals with a digestible guide to the latest AI technologies apt for legal applications.

Core Challenges in AI Adoption for the Legal Industry

In the legal industry, the adoption of AI, particularly Large Language Models (LLMs), while transformative, faces significant challenges that hinder its seamless integration. The problem of "hallucinations," where AI produces convincing yet inaccurate answers, has led to serious repercussions, such as fines imposed on lawyers for utilizing ChatGPT for fictitious legal research. Moreover, the opaque nature of AI's decision-making, termed the "black box" issue, clashes with the legal sector's demand for transparency and reliability. Additionally, AI's struggle to comprehend complex human queries and the dependency on prompt engineering underscore its limitations in contextual understanding. The industry's stringent requirements for data privacy and security further complicate the utilization of cloud-based AI solutions. Finally, the evolving nature of AI models introduces issues of reliability and consistency, as responses to identical queries may vary over time. Together, these challenges underscore the critical need for a cautious and informed approach to leveraging AI in legal practices.

Download the whitepaper for free!

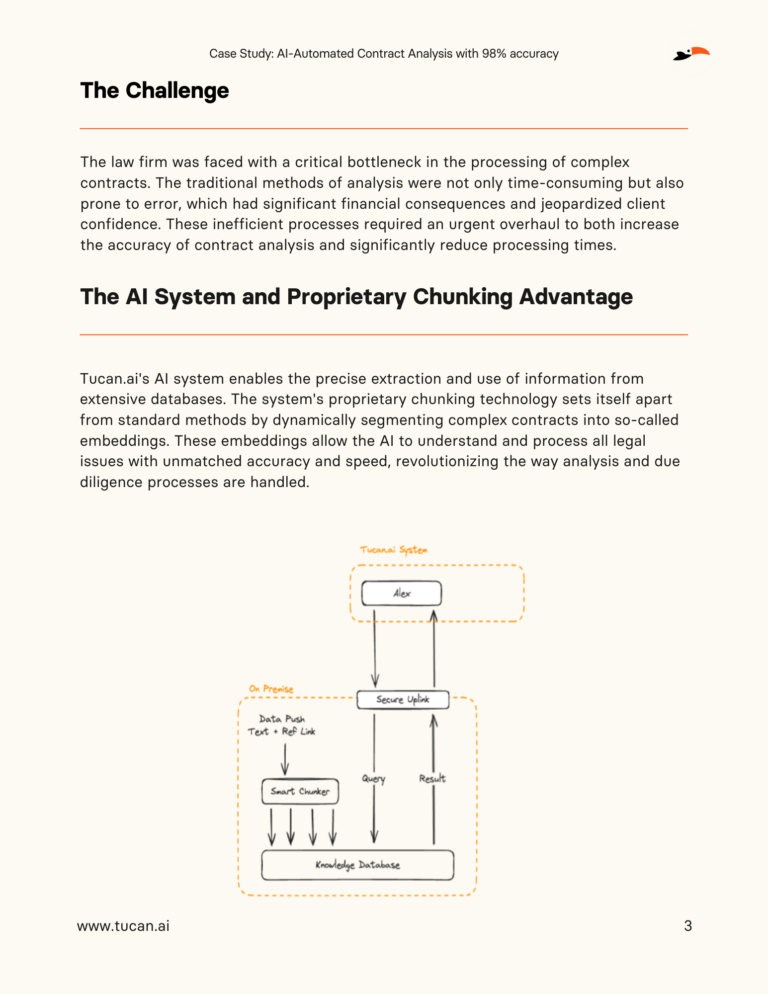

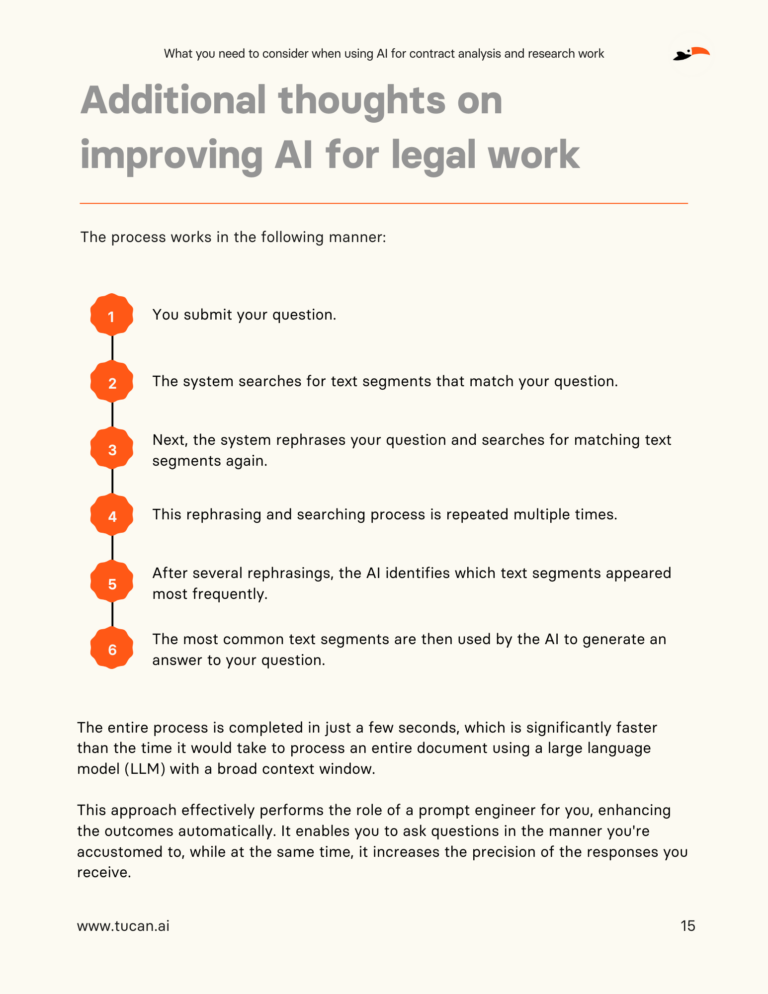

Innovations and Solutions

In the quest for advancing AI's application in the legal sector, notable innovations and solutions are emerging. The introduction of Retrieval Augmented Generation (RAG) systems marks a pivotal advancement, offering a method to deliver precise and accurate answers by breaking down extensive texts into manageable segments. This not only bolsters the accuracy of results but also addresses data privacy concerns by facilitating AI's operation on private servers. Furthermore, the development of novel chunking techniques, which segments texts based on context rather than fixed parameters, significantly enhances AI's capability in analyzing legal documents. Additionally, the automation of prompt engineering represents a breakthrough solution to the challenges of input precision. By developing systems that automatically translate regular legal queries into AI-comprehensible formats, there's a marked improvement in preserving the original intent of questions and enhancing the precision of outcomes. Together, these innovations promise a more effective and secure integration of AI in the legal industry, opening new avenues for its application.

In navigating the complex landscape of AI in the legal industry, understanding its benefits and pitfalls is paramount. Tucan's whitepaper serves as an essential compendium for legal professionals seeking to integrate AI into their practice thoughtfully and successfully.

Download the whitepaper for free!